Why the 2021 Forecast Doesn’t Call for a Foreclosure Crisis

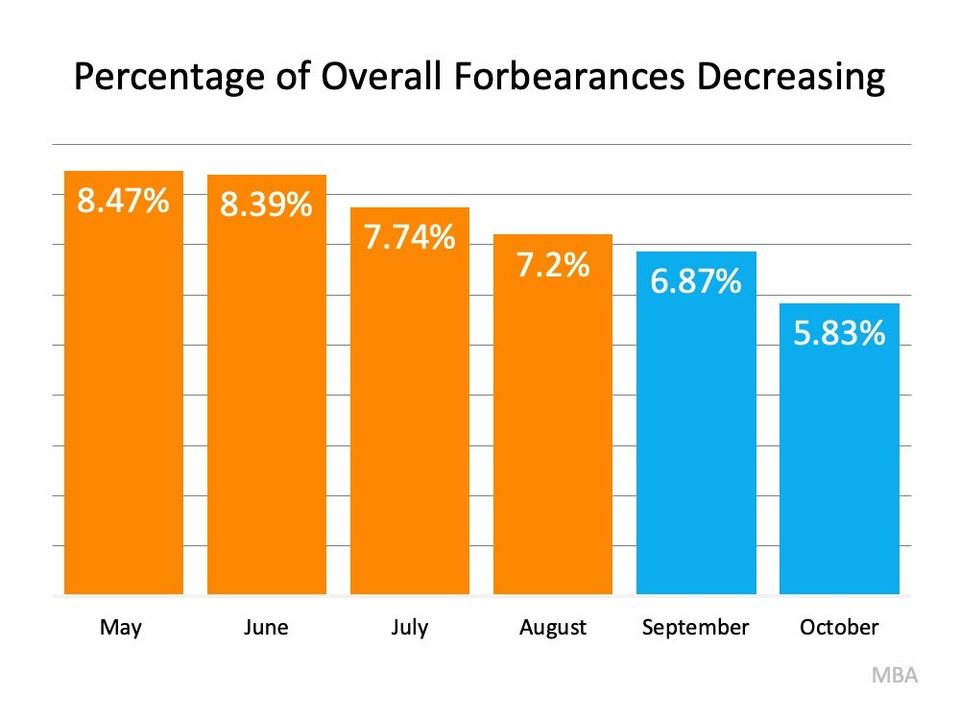

This means there are fewer and fewer homeowners at risk of foreclosure, and many who initially applied for forbearance didn’t end up needing it. Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

For those who are still in forbearance and unable to make their payments, foreclosure isn’t the only option left. In their Homeowner Equity Insights Report, CoreLogic indicates:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity during the past year.”

Many homeowners have enough equity in their homes today to be able to sell their houses instead of foreclosing. Selling and protecting the overall financial investment may be a very solid option for many homeowners. As Ivy Zelman, Founder of Zelman & Associates, mentioned in a recent podcast:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

If you’re currently in forbearance or think you should be because you’re concerned about being able to make your mortgage payments, reach out to your lender to discuss your options and next steps. Having a trusted and knowledgeable professional on your side to guide you is essential in this process and might be the driving factor that helps you stay in your home.